Q1 was a record-breaking quarter for venture capital in TN

Three venture deals - Monogram Health ($375 million), Wellvana ($84 million), and Rain ($116 million) - accounted for three-fourths of the venture capital raised.

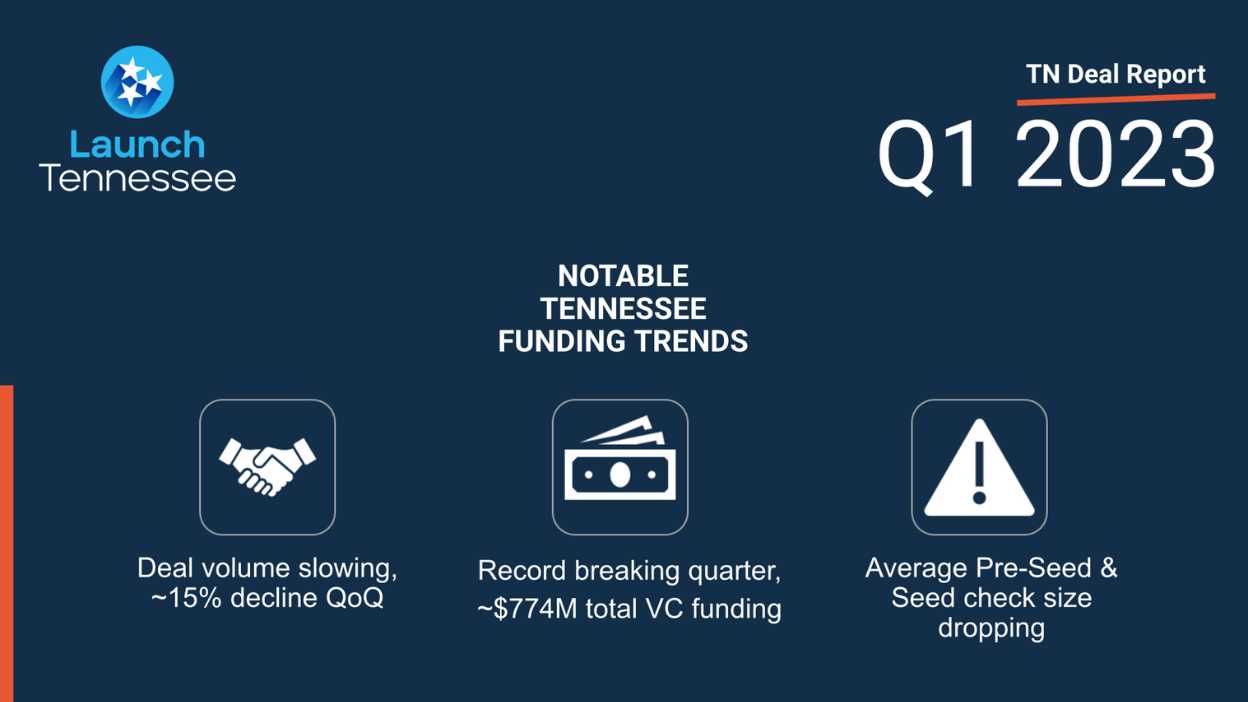

There’s great news but also some looming clouds on the horizon, according to the Q1 “TN Deal Report” compiled and published by Launch Tennessee (LaunchTN).

For starters, the Volunteer State saw a record-breaking quarter with nearly $774 million in total venture capital (VC) funding, almost doubling its second-largest quarter ever. In all, VC investments jumped up 325 percent from the previous quarter and up 211 percent from the same quarter in 2022.

“This (trend) was especially unexpected considering the downward trend of venture funding and in the midst of the banking crisis,” wrote Evan Prislovsky, LaunchTN Capital Analyst.

Q1 saw major investments in three venture deals, including Monogram Health ($375 million), Wellvana ($84 million), and Rain ($116 million). Of the record-breaking VC funding, more than one-half went to healthcare, indicating the strength of that sector, particularly in the Nashville area. Beyond healthcare, fintech, climate tech, and data and artificial intelligence are the other emerging industries seeing rapid growth.

Seed funding was a mixed bag. While the average seed deal size grew by 91 percent year-over-year, the average seed deal size dropped by 7 percent. Also, while there were 23 seed deals in Q4 of 2022, that number decreased to 19 in Q1 of 2023.

Another trend to monitor is the decline in venture funds raised in Tennessee, consistent with national trends.

The Q1 report can be found here.

Like what you've read?

Forward to a friend!